In the first quarter of 2023, gold prices have surged to record highs, reaching levels not seen in over a decade. This surge has taken many investors by surprise, leading them to wonder what is driving the increase in gold prices. In this article, we will explore some of the key factors behind the surge in gold prices, and what it means for investors.

One of the biggest drivers of gold prices is geopolitical tensions and uncertainty. In recent years, tensions between major global powers have risen, leading to increased volatility in financial markets. The ongoing trade war between the United States and China, tensions in the Middle East, and political instability in Europe have all contributed to a sense of uncertainty in the global economy. As a result, many investors have turned to gold as a safe haven asset, driving up prices.

Another key factor behind the surge in gold prices is inflationary pressures. Inflation refers to the rate at which the general level of prices for goods and services is rising. When inflation is high, the value of currency decreases, making it less valuable to investors. Inflationary pressures have been building in recent years, driven by a combination of factors such as low interest rates, rising commodity prices, and supply chain disruptions. Investors have turned to gold as a hedge against inflation, which has driven up demand and prices.

The policies of central banks also play a role in the price of gold. Central banks hold large quantities of gold in their reserves, and their actions can influence the supply and demand for gold. In recent years, central banks around the world have been accumulating gold, as they seek to diversify their reserves away from the US dollar. This has helped to support demand for gold, and has contributed to the increase in prices.

Finally, investor sentiment plays a key role in the price of gold. In times of uncertainty and economic turmoil, investors tend to flock to safe haven assets like gold. This surge in demand can drive up prices, even if the underlying economic fundamentals do not justify such an increase. As more investors turn to gold, this can create a self-reinforcing cycle, driving prices even higher.

In a highly competitive world there is no room for unreliability. This applies to all fields of economic and social activity. In particular, it is particularly

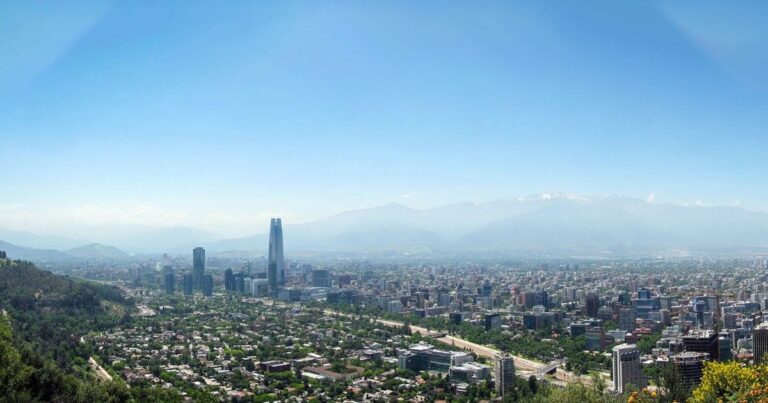

Chile, uno de los países más ricos y con una de las economías más estable de América latina durante las últimas décadas, es noticia a nivel mundial, después de los

A pesar de los momentos difíciles que hemos vivido durante el 2020, los retos a los que nos hemos enfrentado como empresa y los desafíos personales que nos han acompañado